Churn, the silent killer for so many online businesses. It’s a problem that every business with any type of subscription-based pricing model has to deal with.

You spend countless energy time, money and on product development, sales and marketing – acquiring new customers – yet ignore a large percentage of transactions that fail.

This happens both voluntarily and involuntarily.

The fact of the matter is, it’s just a part of doing business. Credit cards will expire. Customer accounts have insufficient funds. There is an error with the payment gateway.

Well, a little thing called “dunning” is here to help.

If you’re sitting here scratching your head when you heard the word “dunning” – listen up, because I’m about to share something with you that will dramatically impact your bottom line (in a good way).

Here we go…

What is Dunning?

To put it simply, dunning is the art of automating the process of recovering lost revenue from failed payments.

Usually, a card gets declined because a payment gateway has encountered an error or the customer has insufficient funds.

While payment recovery is nothing new, there is an art to turning what is a seemingly annoying and frustrating customer experience, to a pleasant process.

Pre-Dunning

Pre-dunning is when you attempt to communicate with the customer in anticipation that their upcoming payment may fail.

There has been an open debate about pre-dunning and whether it is truly effective or if it can have the reverse effect.

I believe it is on a case-by-case basis, depending on the situation and how you approach the customer.

Let’s unpack each scenario.

#1. Their credit card is getting ready to expire – On average, 20-30% of your customers’ credit cards will expire each month. I think it is perfectly acceptable to provide a reminder that their credit card on file is about to expire and to update their details.

A recent study showed that the subscription e-commerce market has spiked more than 100% percent each year over the past five years – and that the average person spends around $200 per month on subscriptions.

It’s a good argument to say that your customer may by juggling multiple subscriptions and forget to update their payment details and need a reminder. However, I think there is a limit as to how many times you should remind them, before it actually fails. A best practice is to remind them 30 days before their card expires and then 7 days before (if they haven’t already updated their payment details).

#2. When there are long delays in between billing periods – Typically the longer the duration is between billing periods, the higher that customer is at risk of their payment failing. For those who offer payment options of bi-annual, annual, or longer, it may be worth sending that customer a reminder about their upcoming charge and to ensure their payment method and details are still good.

#3. Their first payment after a free trial – Whether you collect payment information or not at sign-up, I believe it’s just good business to be transparent early on about when you will start charging the customer. That is why I think it’s a good best practice to let the customer know “your free trial is about to end and we will start billing you [this amount] on [this date]”. This can help avoid that angry customer who signed up for a trial, however, they realized the product or service wasn’t a good fit and they simply forgot to cancel their subscription before the first charge.

#4. Before every rebill attempt – This is probably the only scenario in which I would not send a reminder to the customer. I’m sure everyone can relate when they receive reminders of an upcoming charge each and every month – it gets annoying, right? Hence, why I feel this may be a bit overboard and counterproductive.

Tip: Try asking your customers to switch from credit card to ACH, as ACH payments decline at around 2%.

Overall, pre-dunning is meant to bring on fewer support requests, fewer cancellations and increase the likelihood for a successful payment. Regardless of which pre-dunning notifications you send to your customer, I highly recommend a friendly message that adds value and provides step-by-step instructions on how they can update their payment details.

The Dunning Process

Now let’s assume that a payment has failed already. This is now your normal “dunning” sequence, where we are going to attempt to contact the customer to retain the failed payment.

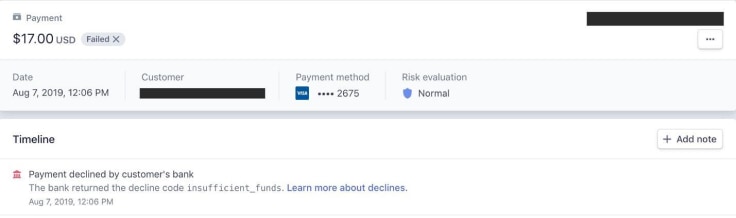

There are a number of ways we can go about recovery payment. The first thing to do is identify why it failed?

Let’s go over the primary reasons…

#1. Credit card expired – this is by far the most common reason that payments fail. As I mentioned earlier, about 30% of your customers cards will fail – as most credit cards have a lifespan of one to four years, before the customer is issued a new one. While a pre-dunning sequence can help capture some of the expiring cards, many will still slip through the cracks and will still require a proper notification sequence to have them update their payment method with the new details.

#2. Insufficient funds – this is a bit of a tricky one, as you don’t fully understand why the customers ran out of funds. Was their credit limit reached? Are they using a debit card and funds have been depleted from their checking account?

There are a few things you can do to combat these scenarios. You could send an email notifying them that there were insufficient funds and to see if there was a better day of the month to process their payment. For customers where money is tight, sometimes it can be as easy as having the transaction processed on the day they get paid.

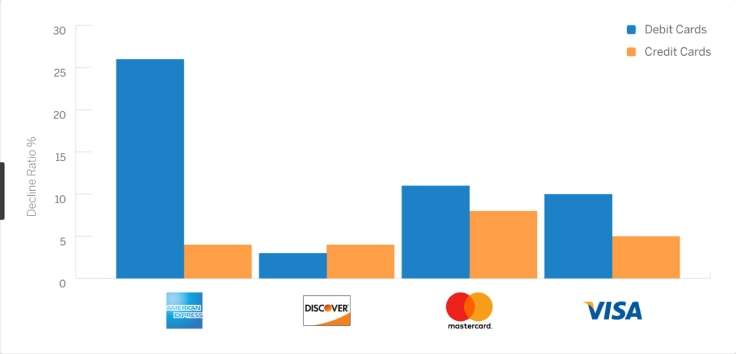

One reason that we added the option to choose if you wish to accept debit/pre-paid cards in our PayKickstart platform was because it’s been proven that these cards can get declined up to 6x more often. So, while blocking debit cards may lower conversion rates, it can help minimize failed payments.

#3. Payment gateway error – Payment gateways like Stripe, Braintree and PayPal have literally hundreds of error messages that could be flagged for any number of reasons. It is important to monitor the logs of those error messages to ensure the reason customer transactions are declining is not related to the status of your account.

Post-Dunning

There actually is another part of the dunning process that can come even after the payment recovery attempts have failed.

At this point, you have to assume that the customer is either not receiving your notifications to update their billing details or they decided to let the subscription cancel on its own, as they no longer are using the product or service.

Let’s discuss both scenarios…

Customer is not receiving your payment recovery notifications – If your customer has not received your notifications, it may just be a matter of reaching out to them through a different channel. The SMTP service you use to deliver transactional emails should have a record of if the emails were delivered to the recipient. If you notice a soft or hard bounce, odds are they are not receiving your emails.

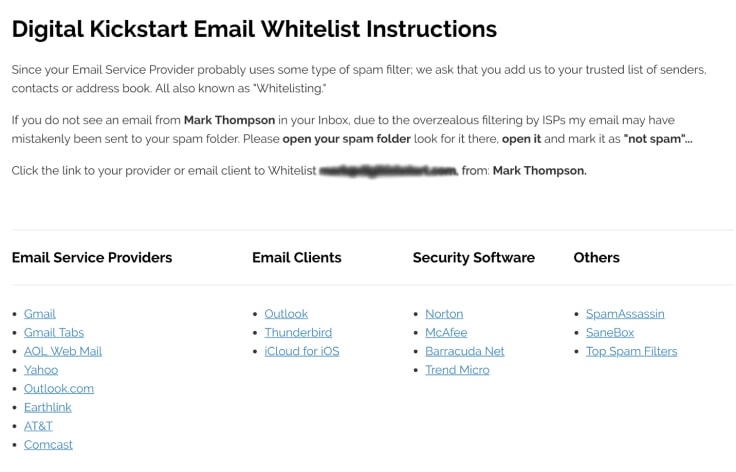

Tip: At the time of first communication, ask the customer to make sure they white-list the email you send from. Here is an example of the landing page we created where the customer can click the ESP they use and follow the instructions.

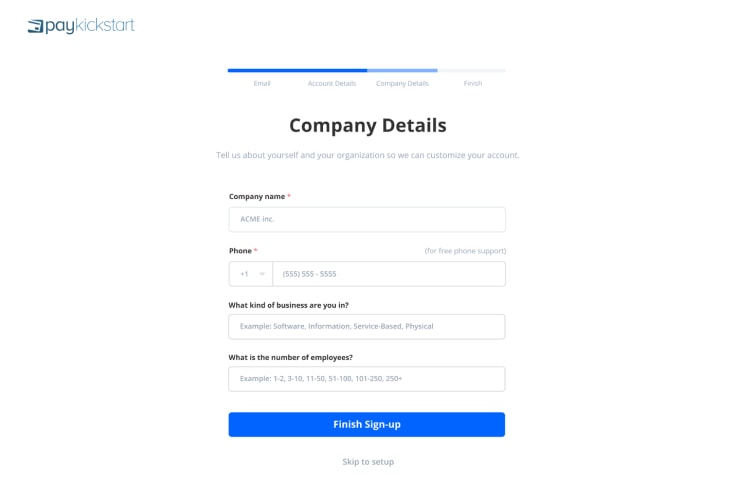

You can also ask for additional contact information at sign-up or their “my profile” area. Asking them to opt-in to SMS/calls for “free phone support” is a great way to provide value when asking for additional information.

Here is an example of how we request phone details along with other company-related info at sign-up.

Customer is no longer is using the product or service – While technically this is not a “dunning” strategy, I think it fits in with the hold concept of payment recovery and minimizing churn.

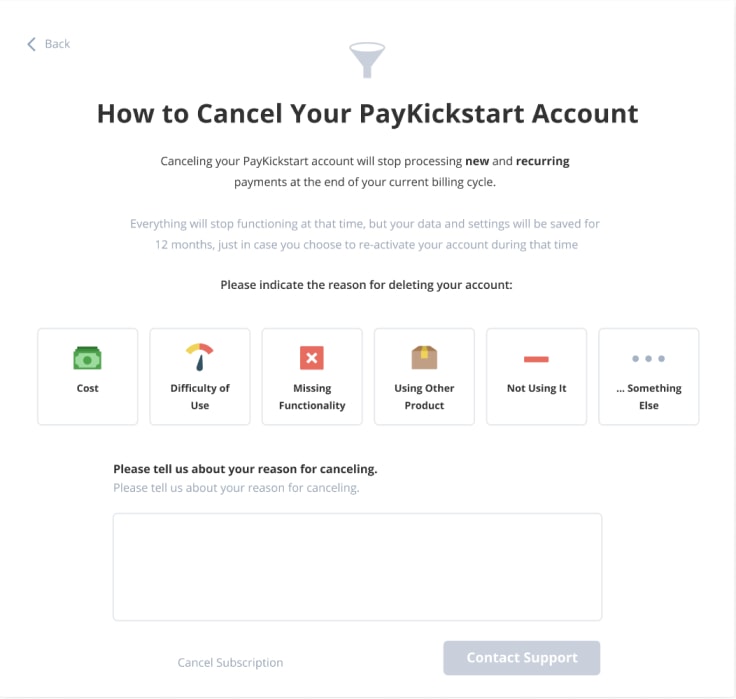

While some customers will naturally let the dunning process play out until their subscription has canceled – for the customers who ask to cancel deliberately, it’s critical to collect information that would let you know “why” they have chosen to cancel the subscription.

An example of the customer cancellation saver feature can be found below, which will automatically attempt to resolve the customer’s dissatisfaction based on the selected cancellation reason.

In cases where a customer does proceed with their cancellation, you would still have feedback letting you know what let to their decision to cancel their plan. This is helpful as it provides an opportunity to reach out to the customer later on in an attempt to get them to sign up for the subscription again.

Here are a few examples:

- If a customer reported that they are canceling due to missing functionality, you could add them to a feature request and notify them once the feature they asked for is released.

- If the reason was the difficulty of use, you may want to reach out to these past customers once you have improved your product’s onboarding and user experience.

- In cases where the product’s price is the issue, reach out to these customers if you start offering discounts, add more plans or change your pricing based on user feedback.

While a canceled subscription is post-dunning, there is always the opportunity to reactivate those customers.

The Perfect Dunning Template & Schedule

At PayKickstart, as a platform, we have collectively recovered over $1 million dollars in failed rebills – testing different language, sequences, and delivery methods to figure out the perfect approach to maximize payment recovery.

Here is what we found to work the best:

Timing & Channel

When and how you send your dunning sequence to a customer can impact the likelihood of them following through. From our experience, customers often don’t respond to your first email. It’s usually the second or third that will get a better response.

Whether you are sending emails before or after a payment has failed, you need to look for the right balance between communicating urgency and being plain annoying.

Our typical dunning sequence for when a payment has failed is a four-email sequence, spaced out over 7-10 days.

A standard sequence would look something like this:

Email #1: Immediately after decline

Email #2: 2 Days after email #1

Email #3: 3 Days after email #2

Email #4: 2-3 Days after email #3 (subscription cancelled)

Channel

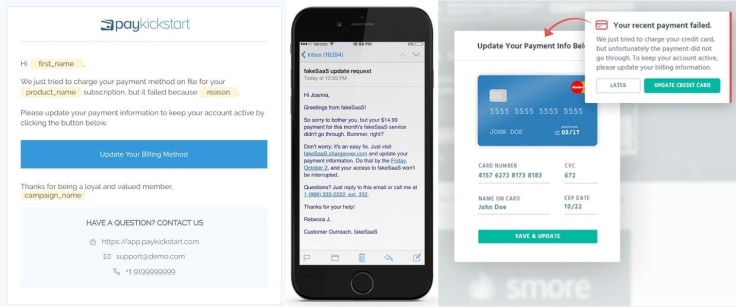

The most common approach to dunning communication has been email. However, with the average person receiving over 100+ emails per day, your dunning emails could get buried. By utilizing a multi-channel approach, it has a higher chance of being received by your customer – further increasing your payment recovery rates.

The ultimate combination would be Email + In-App Notification + SMS/Text Message – staggering channels for each customer communication.

From Name/Address

Make sure that whatever email address you are sending from, is not a “Do not reply” email. This can lead to more frustration with your customer if they have a billing question and are unable to contact support.

We typically like to send from [Product Name] [email protected], but I’ve seen plenty of other companies use things like [Product Name] Billing [email protected]. For companies that work with Enterprise clients, it may be best to have these emails sent from the account manager – as they most likely have a working relationship with the customer and they will recognize the name and email.

Voice and Tone

I’m sure you get it – it’s annoying when your payment fails and you need to go and update your details. So, ensure that your tone and messaging don’t sound like a debt collector coming after your firstborn. Keep it mild, polite, and empathetic – assuming it was just an honest oversight. Even as you get further along in the dunning sequence, you can still be polite and empathetic, while conveying the severity of the issue.

Email Subject Line

The subject line is probably the most important aspect of the dunning process, similar to a marketing email – it’s what determines if the recipient should open it or not.

Here are some good examples:

- Uh-oh! Your payment for [product name] failed.

- [First name], Please update your billing information

- Action Required: A payment has failed

- Invoice #9999 is [timeframe] overdue

- 2nd notice: Another unsuccessful payment for your [product name] subscription

- Final notice: Need updated [product name] billing information

- Invoice #9999 from [Date] is overdue—please send payment ASAP

- Warning! Your [Product Name] subscription may be canceled

- “Action required: Payment failure due to [EXPIRED CARD].

As you can see, the language that is used slowly becomes more urgent, the longer they’re in a delinquent status.

Also, you will notice that the subject lines vary slightly. This is important, particularly with Gmail, as they “thread” emails with the same subject line, which means there’s a bigger chance of them missing subsequence emails.

Now let’s analyze the Email Body.

Trust Factor

There are a lot of scams out there where people are trying to obtain people’s credit card information. This is why it’s important that your email invokes trust – including your logo, using your brand’s colors, footer links to your privacy policy, TOS, etc…and let them know that they will be redirected to an SSL encrypted page.

Explain Next Steps

While it may seem a bit extreme, it’s important to make your intentions and the customer’s next steps crystal clear.

- Tell them who you are, the role, and the company you represent.

- Personalize the email – specifying the payment type, unique identifier (ie: last 4 digits of the card), plan name, the amount owed, and reason for their payment declining.

- When you will attempt to process the next payment.

- A link to where they can go to update their payment details.

Include Value Proposition

Something that most companies leave out in their dunning emails (however it so important) is to reiterate the value proposition. Essentially explaining to them what benefits they will be missing out on if they decide not to update their details.

A percentage of your delinquent customers just let their subscription cancel on its own – so it’s important to resell them on why they purchased your product/service in the first place.

Increase the Urgency

The longer the customer is delinquent, you want to slowly start to stress the urgency. Similar to how conversion rates skyrocket during the last few hours of a time-sensitive offer, the same will happen for having customers update their billing details to avoid disruption in their service.

Here are a bunch of dunning email templates that utilize these best practices, that can be used for inspiration.

Putting Dunning into Practice

While you could always implement dunning into your business manually, I would strongly recommend not going down that path. The cost to manually write each template, set up automation rules, and create a customer billing system to allow customers to update their details can be extremely costly.

The good news is that there are a number of companies and tools out there that will handle the heavy lifting for you.

While payment gateways like Stripe and PayPal have built-in dunning, they typically are fairly limited, with restricted functionality and control.

There are also services like Stunning.io and Retain by ProfitWell that connect to your existing Stripe account to enhance your dunning management. The limitation there is that you are required to use Stripe as your payment gateway and you also pay a percentage of any revenue recovered.

The third option is to utilize a shopping cart like PayKickstart that has dunning management baked right into the overall platform. A system that includes multi-channel support, customizable email templates, full control over when and how communication is handled, and the ability to have more variety over what payment processor you use.