As an online retailer, there are several pricing strategies you can adopt or combine. Cost-plus pricing is the easiest-to-apply strategy that can save you all the time on earth. But is it effective?

By the end of this article, you’ll learn:

- How to implement cost-plus pricing with examples

- Whether it is an effective strategy for online retailers

- Advantages and disadvantages (in the FAQ section).

What is cost-plus pricing?

Cost plus approach is a cost-based pricing strategy where a business calculates the costs of a product and adds the desired markup on top.

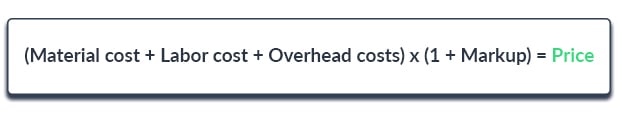

You can calculate the price for a product by using the formula below.

Overhead costs refer to the costs of operating a business. In addition, some of the ecommerce business costs are listed below. Most of them are not directly linked to the production process.

- Your domain

- Website hosting

- Rent (if you have an office space)

- Storing your products in a warehouse

- Shipping costs if you consolidate these for your customers

- Salaries

- Utilities

- Raw materials (if you manufacture the products yourself)

- Marketing budget

- Credit card fees

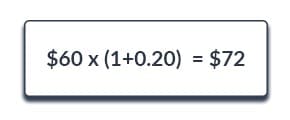

The markup, however, entirely depends on the targeted profit. Let’s go over a cost-based pricing example to help you understand the markup pricing. Suppose you sell a speaker and target a 20% profit per unit. The overall cost per unit is $60.

Here’s how you calculate the final selling price.

Who uses cost-plus pricing?

Traditionally, fashion brands implemented cost-plus pricing for its simplicity and convenience. But simplicity doesn’t bring success anymore. Online retailers must have competitive prices to attract price-sensitive shoppers in a world where these shoppers can easily access the best deals.

Cost-plus pricing doesn’t answer ecommerce business objectives and needs. That’s why many businesses formerly using this strategy dropped it and moved on to more competitive strategies while transforming to digital.

So, let’s explain why it damages a company’s competitive strength.

Say our store sells consumer electronics. After calculating the costs, the owner adds a 50% markup. Why not? Since she doesn’t track competitor prices, she doesn’t know where her prices stand against competitors.

Let’s put ourselves in consumers’ shoes. Which store would you prefer?

We thought so. A pricing strategy based solely on costs hurts your business more than you imagine.

Merge it with other pricing strategies

Implementing cost-plus pricing as the sole pricing strategy impairs your competitive strength. Whereas when you implement it as a part of a dynamic pricing strategy, it allows you to price your products risk-free. How, you might ask.

Use pricing software. The software tracks competitor prices and automatically adjusts prices against competitors. But also, it limits the minimum price to ensure your costs are covered.

Final words

Cost-plus pricing is a strategy where a retailer sets the price of a product by adding a markup on the overall costs. It’s not very complicated or time-consuming, but it has many downsides.

Instead of implementing it as a single pricing strategy, you can merge it with dynamic pricing. Smart pricing rules provided by the pricing software can set rules that’ll cover costs, as well as automatically adjust prices against competitors.

Frequently Asked Questions

– Extremely easy to apply.

– It doesn’t cost you a penny.

– Time-efficient, especially if you have thousands of products to price.

– It makes sure you cover your costs (unless you miscalculate your costs).

– Completely ignores competitor prices, which are of central importance to ecommerce pricing.

– Neglects product value. Two items that are produced at the same cost might deliver extremely different values to the customer.

– Fixed prices prevent you from testing different prices that yield different levels of demand.

– Sets you back from segmenting your audience and personalizing your offers despite their necessity. It causes long-term inefficiency.

– Drives businesses to lower costs instead of working on the value they deliver.

Price = (Material cost + Labor cost + Overhead costs) x (1 + Markup)

I really understand cost plus pricing now