Target return pricing is a pricing strategy used by many ecommerce experts. It helps them set the price of a product based on the expected rate of return of their business.

It sounds more complicated than it is. If you’ve ever studied business or economics, you’ll know about break-even margins and profit-margin calculations. They helps you understand what different prices mean for your business. 👇

In simple terms, an ecommerce store would use this pricing strategy to set their prices. They’d price the product that would give them a specific profit if a given quantity is sold.

In this post you’ll learn:

- What Target return pricing is

- How do you price a product to sell

- How do you calculate the target rate of return

- Examples of target rate return to help you get started.

Let’s go!

How do you price a product to sell?

Before you begin to sell anything on your ecommerce store, you need to know what price you want to sell it at. As you already know, prices are subject to change and will fluctuate throughout the lifespan of your business.

However, the initial price you set should be backed by data and informed by proper decisions. One of the easiest ways to work out the initial price is to find out how much it costs you to run your business.

If you spend $5 creating your product and a further $2 marketing it, that’s a total outgoing of $7. If you decide to sell your product for $6, you’re effectively selling at a loss.

So before you start thinking about different psychological pricing strategies to implement, first work out the lowest price point you need to sell to keep running your business in profit.

What is the target price strategy?

When your ecommerce store starts thinking about using a target price strategy, the first step is to determine how much profit you’d like to make from your products.

However, like with any pricing strategy, it’s not without its downsides. This strategy doesn’t consider the price elasticity of specific items or competitor pricing.

So, when looking at target return, you’re concerned with how much an investor (could be internal or external) would want to make from the capital they’ve invested in the company.

But because the investor has to pick a return that can be easily achieved as well as a realistic time frame, you’ll find many fall into issues. If you pick a high return over a short time frame, you’ll have to work harder to make your ecommerce store profitable in less time, compared to if the investor wanted a lower return over the same or longer time period.

How do you calculate the target rate of return?

When it comes to calculating the target rate of return, you need to review a range of scenarios. It’s for understanding the impact each would have on your sales volume and profit better. Ideally, you’ll have a goal for return on cost.

You come up with a price that gives you the target return on investment. Then, the product of the desired rate of return plus your capital investment gives you the total return.

Money invested in the venture + profit that the investor wants to see in return. (adjust this for the time value of money).

It involves working backward from what they want to see to work out how much they’d need to charge and thus sell to get there.

Examples of target return

One of the benefits of using target return is it helps you think about a profit-first approach to your business. For example, if your sales don’t quite hit what you expected, then you know you need to adjust your prices to achieve your target.

Let’s look at this through a real-life example.

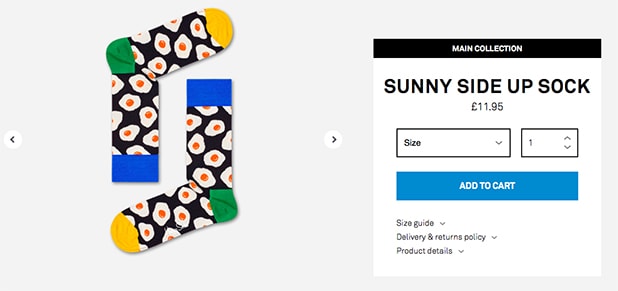

Let’s say HappySocks investors have stated that they want a target return of 10% on their $1 million investment. If it costs Happy Socks $2 to manufacture each sock, and they hope to sell 50,000 within their timeframe, that means that the price should be high enough to ensure that they make 10% of 1 million by the end of the time frame which is 100,000.

If they find they cannot sell all 50,000 units, then Happy Socks can increase their prices to account for the new targets they need to hit.

Target-Return Pricing = unit cost + (desired return x invested capital) /unit sales

Final thoughts

Target return pricing strategy is an advanced strategy. Many ecommerce stores only think about using it once they’ve matured and taken external support in the form of investment.

To recap the key points:

- Your target return price should be equal to the profit that an investor expects from their investment.

- It places a strong emphasis on the time value of money

- Investors must work backward from the expected return to reach the typical current price

- This strategy differs from cost-plus pricing as the latter simply takes manufacturing costs and adds a markup.

Nice blog. I found this blog very useful. Your blog will be very beneficial for everyone. I have bookmarked your website. Please keep your effort continuous and keep providing us your valuable information and suggestions.

Thank you for helping people find the info they need. Good stuff as usual. Keep up the great work!!!

There appears to be an incomplete sentence this:

What is the target price strategy?

When your e-commerce store starts thinking about using target price strategy, the first step

However

Thought you'd like to know!

I truly appreciate this post. Really thank you!

Thank you for your attention, Cal. We've fixed it up.