The laws of supply and demand play a big role in determining the price of a product or service. But sticky prices have an inclination to remain the same or resist to changing fast despite the shifts in supply and demand. Since ecommerce is a dynamic market where prices are constantly adjusted, sticky prices can seriously damage your business.

What is price stickiness?

Price stickiness, also known as nominal rigidity, is the resistance of the price of a product or service against changes in costs, supply, and demand.

For economists, it’s a market inefficiency. Meaning that, it’s an element of the market economy that makes it less close to perfection.

To better understand what it means, let’s look at a well-known example.

Like every other product or service on the face of the earth, our labor has a price. It’s our wages.

A guy works at a supermarket and a new employee is recruited. When she came to help, the workload on our old-timer declined. In other words, demand for his work has decreased. Would you expect a decrease in his wage, too? Don’t think so.

That’s because the wage is a sticky price.

Real-life examples of sticky prices

Perhaps you’ve noticed that the demand for iPhones has been decreasing during the past few years. However, its price was sticky. Even if the demand continued to fall, the prices remained high until the release of the iPhone 11.

Price stickiness can be both downwards and upwards. Looking back at our wage example, we see that our wages can increase, but they are highly unlikely to decrease. Wages have downward stickiness.

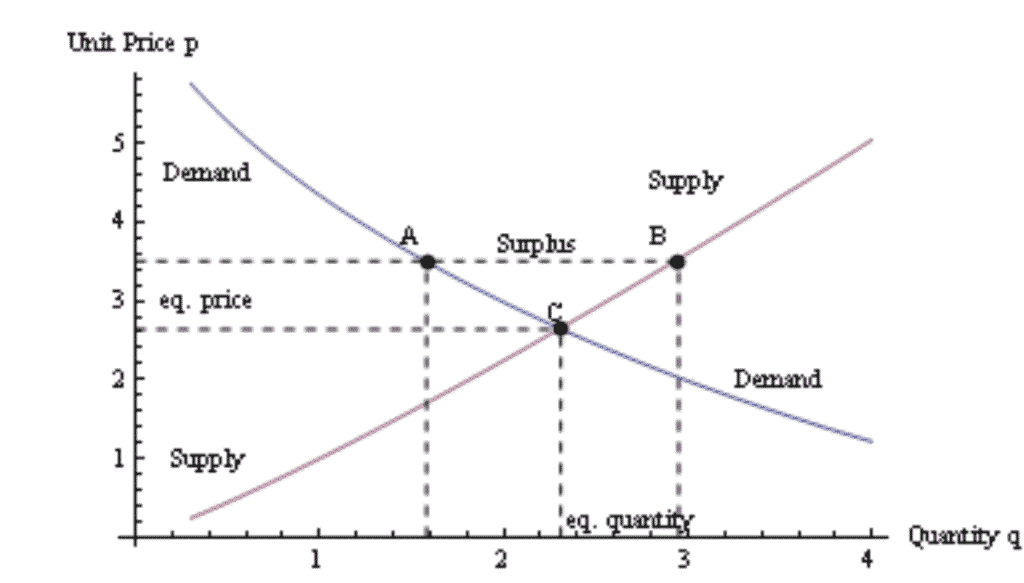

Sticky downwards

In downward sticky pricing, there is a resistance to prices adjusting downwards. Then, “when the market-clearing price drops (due to an inward shift of the demand curve or an outward shift of the supply curve), the price remains artificially higher than the new market-clearing level, resulting in excess supply (surplus).”

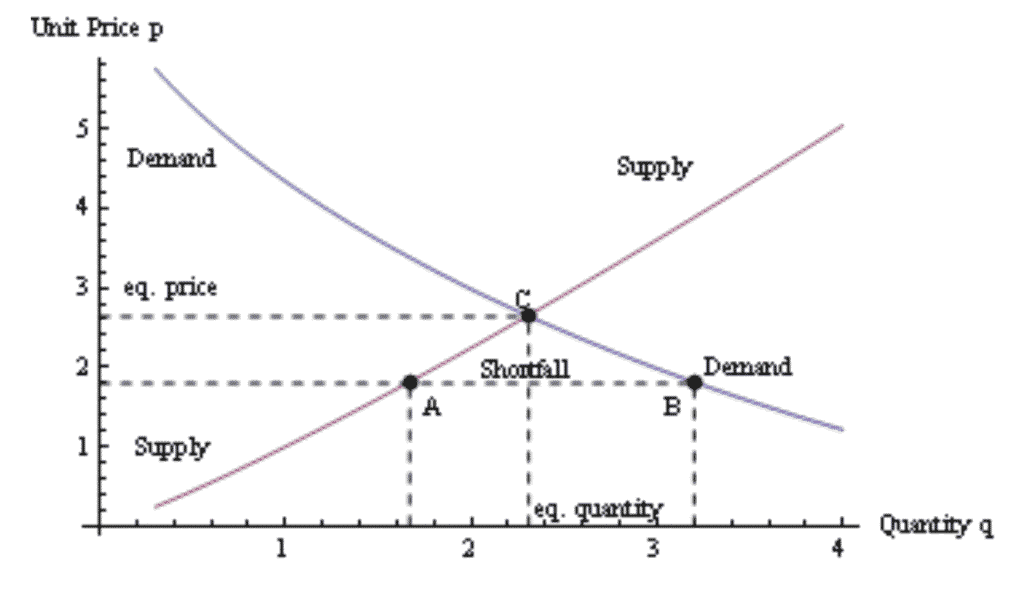

Sticky upwards

Upward sticky pricing means that there is resistance to the prices adjusting upward. Therefore, when the market-clearing price rises (due to an outward shift of the demand curve or an inward shift of the supply curve), the price remains artificially lower than the new market-clearing level, resulting in excess demand (shortfall).

You must wonder what the relationship is between sticky prices and the ecommerce industry.

How does this relate to ecommerce?

Research suggests that sticky prices are costly. Companies with stickier prices experience greater volatility of returns, especially after monetary shocks.

To put it more simply, if you are able to react to changes in demand and supply with price adjustments, you can compensate for your loss. How so?

Let’s say, a new competitor entered the market. Her prices are somewhat cheaper than yours. Maybe her firm’s operational costs are lower than your company’s. You can’t singlehandedly level the playing field, but you can lower your prices to sell more than her.

Even if your profit per unit decreases, you can still boost your sales and profit more than her with the right price adjustments. But sticky prices prevent you from testing different price points that yield different levels of demand.

Why is ecommerce well-suited for frequent price changes?

You know as well as any shopper how frustrating it is to buy something and see it reduced in price the next day.

Your customers are no different.

This doesn’t mean, however, that they’re completely against price changes. They understand, for example, that the price of seasonal products may change throughout the year.

Often, too many ecommerce retailers are far too cautious when it comes to changing their products.

Ecommerce vendors have an advantage over brick-and-mortar stores. In a physical store, you need to get new labels printed and add them to the system.

However, in online stores, this entire process is much simpler. In fact, prices can be changed with the click of a button.

That’s why online retailers have a better advantage when it comes to changing prices to scoop up some of the profits generated.

On the other hand, we can even assume that changing prices is not optional. Harvard Business School economist Alberto Cavallo published a research paper pointing out that the competitive pressure from Amazon forces a greater amount of price changes and more uniformity in prices across different locations.

You can’t risk being left out of the competition when you don’t adjust prices against competitors.

That’s why we offer price tracking software service for our customers, one that doesn’t only track competitor prices but also automatically adjusts your prices against theirs.

A quick wrap-up

Sticky prices can be hurtful for ecommerce businesses. First, because price adjustments are necessary to stay competitive, and second, price changes are not very costly for online retailers. While every other ecommerce owner frequently changes prices, why wouldn’t you?

Perhaps you are trying to avoid annoying your customers, but you might even alienate them with your above-average prices if you stick to them for too long. Instead, try to keep up with competitors and offer competitive prices.